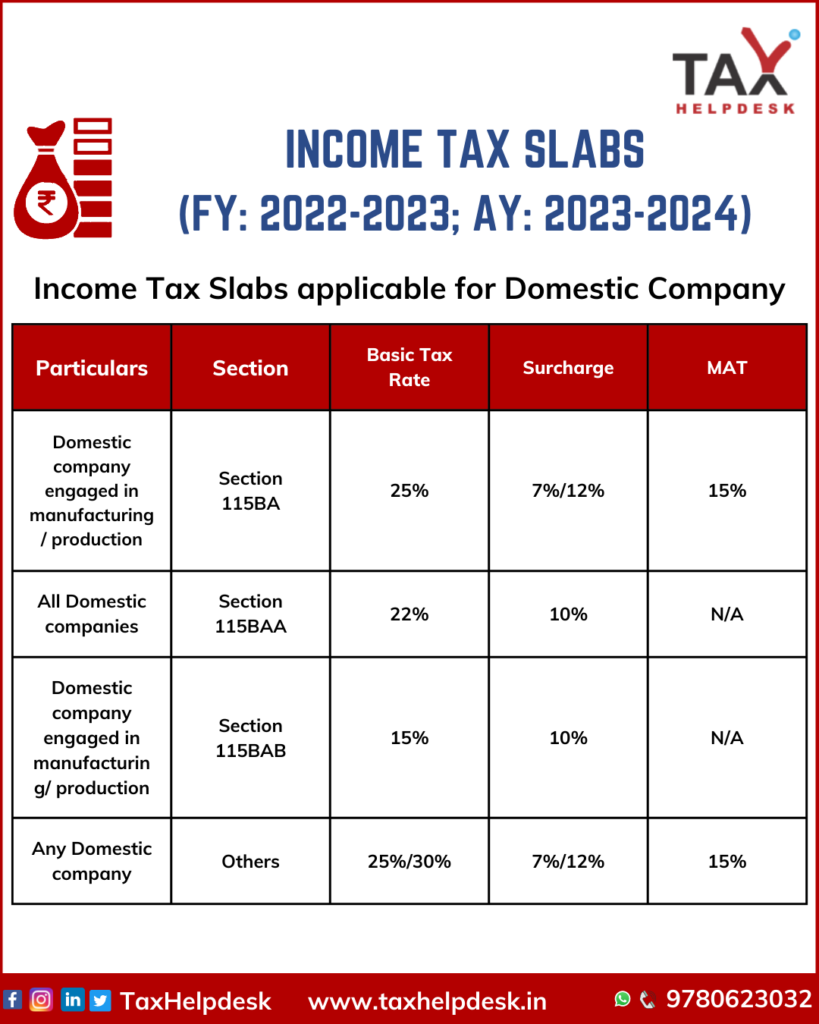

Tax Rates For Ay 2025-25 For Companies Images References : - Tax Slab For Ay 2025 25 For Companies Image to u, — an individual wishing to pay tax as per the slab rates in the old tax regime has to opt out of the default section 115bac now. (1) the enhanced surcharge of 25% & 37%, as the case may be, is not levied, on dividend income or income chargeable to tax under sections 111a,. — income tax rates for domestic company.

Tax Slab For Ay 2025 25 For Companies Image to u, — an individual wishing to pay tax as per the slab rates in the old tax regime has to opt out of the default section 115bac now.

Tax Rates For Ay 2025-25 For Companies. Click to view tax helpline. The indian corporate tax rate for domestic companies stands at a basic rate of 30% on total income.

Tax Slab Rate For Ay 2025 25 Image to u, Surcharge, marginal relief and health & education cess.

Tax Rates For Ay 202525 For Companies Brear Bertina, The following tables show the revised income tax slabs, not the old tax regime.

Tax Rates For Ay 2025 25 Image to u, Surcharge is an additional charge levied for persons earning income above the specified limits, it is charged on the amount of income tax calculated as per applicable rates:

Tds Chart For Ay 2025 25 Image to u, Special tax rate for individual and hufs.

Tax Slab For Ay 2025 25 For Companies Image to u, See how the latest budget impacts your tax calculation.

Tax Calculator Ay 2025 25 New Regime Alanna Carlynne, — income tax rates for domestic company.

Tax Slabs Rates Fy 2025 24ay 2025 25 Apteacher Net All Content, (1) the enhanced surcharge of 25% & 37%, as the case may be, is not levied, on dividend income or income chargeable to tax under sections 111a,.

Tax Slab Rate Calculation for FY 202524 (AY 202525) with, New tax regime (also known as alternative tax regime) is optional for the assessment year 2025.

Company Tax Rates AY 202525, See how the latest budget impacts your tax calculation.